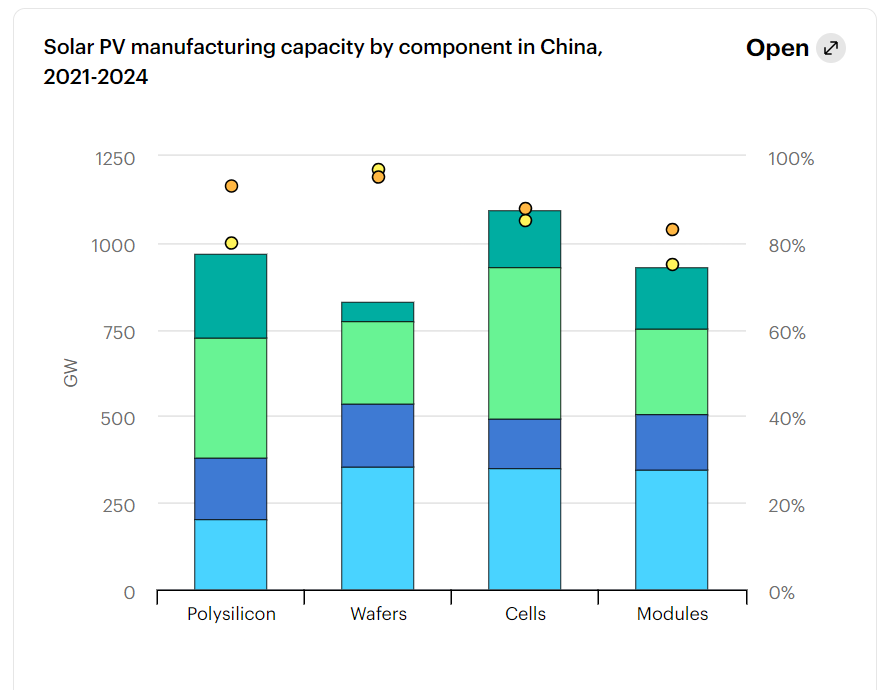

In 2021, China held a staggering 75 percent market share in global module production. By 2024, this percentage surged to 83 percent. Just three years ago, they accounted for 85 percent of all photovoltaic cells produced worldwide. Today, that number has climbed to 88 percent, with a clear upward trend. Additionally, solar wafers, or solar cells, are almost exclusively produced by China, covering an astonishing 95 percent of global production.

They also dominate in the crucial element for production of all other parts of photovoltaic power plants – the manufacturing of polycrystalline silicon. This high-purity form of silicon serves as a fundamental raw material in the solar photovoltaic (PV) technology supply chain. Polycrystalline silicon is melted at high temperatures to produce ingots, which are then sliced into thin wafers and further processed into solar cells and modules. They have covered 93 percent of the market there.

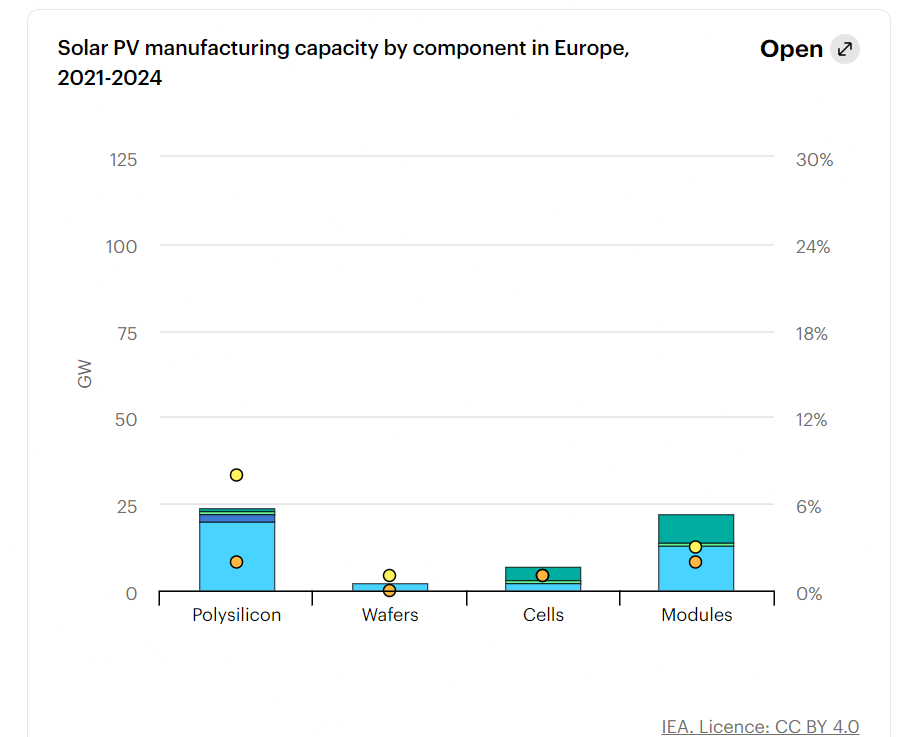

Meanwhile, the European Union’s production of modules stands at approximately 2 percent, marking a decrease of one percent compared to 2021.

The share in cell production barely reaches one percent, and it is not producing solar cells at all, while it experienced a significant decline in the production of polycrystalline silicon. In 2021, the EU contributed approximately 8 percent to the total production of this material, but by 2024, this figure plummeted to just two percent.

How did China become such a strong player in the production of all these elements?

One Chinese province stands out in particular for its dominance in the production of elements for photovoltaic power plants, covering everything from ore extraction to transportation, processing, and the final product. That province is Xinjiang, which holds an overwhelming position in the global supply chain of solar panels.

If you are familiar with the name of this province, it’s likely due to the accusations of the illegal detention of China’s Islamic Uyghur minority.

The full name of the province is Xinjiang Uyghur Autonomous Region (XUAR or Uyghur Region), and it is the primary source of the majority of panels being rapidly installed in Europe, including in BiH, as part of the ongoing green transition.

The Forced Labor Lab at Sheffield Hallam University in England conducted a research in this province. The Uyghur region produces between one-third and one-half of the world’s polycrystalline silicon for solar use. According to their claims the Chinese government has deliberately shifted production to this region over the past fifteen years, leading to a decrease in the price of this critical product. It consequently resulted in the closure of production facilities in other parts of the world claims Laura Murphy, a researcher on modern slavery and a professor specializing in human rights and modern slavery, who is the author of several papers dealing with this issue.

Based on Laura Murphy’s and similar reports regarding the state of human rights in the Uyghur region, the United States of America introduced the Uyghur Forced Labor Prevention Act (UFLPA) in 2021. Subsequently, there was a decline in equipment imports from that area.

The Uyghur Forced Labor Prevention Law operates under the assumption that all products originating in Xinjiang are the result of forced labor unless proven otherwise. This places the burden of proof on Chinese manufacturers and US companies, who must furnish clear and convincing evidence that their imports from Xinjiang were not produced using forced labor.

The report reads:

“This report tackles the issue of transparency by mapping, to the best extent possible with available data and expertise in the field, the supply chains of major solar module manufacturers, along with selected other manufacturers. With the data at hand, the report evaluates the exposure of ten manufacturers to the Uyghur region, carefully considering their size and diversity. The assessment includes the five largest manufacturers, which collectively produce 70 percent of the world’s solar modules, as well as some smaller brands. It encompasses companies operating in China, Southeast Asia, the EU, and the US; reviewing some manufacturers previously known to be associated with the Uyghur region and others suspected to have less exposure. Additionally, we have selected some companies that are highly vertically integrated and those that rely on external suppliers throughout the value chain.

Due to the reluctance of the vast majority of companies to fully disclose their supply chains, this report relies on the expertise of solar industry specialists to analyze certain non-transparent aspects of these supply chains.

Every company was given the chance to revise or augment the supply chain information presented in this report and to address our assertions. However, the majority of companies either did not respond or cited China’s anti-sanctions and anti-espionage legislation as reasons for withholding detailed information about their supply chains.

Highlights of the report include the following: The Uyghur region now accounts for approximately 35 percent of the world’s polycrystalline silicon (down from 45 percent) and as much as 32 percent of global metallurgical silicon production.

The vast majority of modules produced globally are still exposed to the Uyghur region. Manufacturing in China significantly increases exposure. Some of the world’s largest module manufacturers appear to have split their supply chains to create product lines they claim are XUAR-free, although evidence for these claims varies by supplier. Most companies suggest that these supply chains are dedicated to the US market or designed with UFLPA compliance in mind. The share of modules produced by China-based companies in these dedicated supply chains appears to range from 7-14 percent of the total production capacity of these companies globally. Companies that have created supply chains purportedly free of XUAR inputs continue to source from suppliers or sub-suppliers with exposure to the Uyghur region for other product lines. It is sometimes impossible to determine whether these product lines are truly XUAR-free because companies do not disclose enough information about their supply chains.”

Several major solar companies have been linked to the use of forced labor within their solar energy supply chains. The companies mentioned in these reports include GCL-Poly, East Hope Group, Daqo New Energy, Xinte Energy, Jinko Solar, JA Solar, LONGi Solar, Trina Solar, BYD, Hanwha Q Cells, and Canadian Solar.

Introducing strict regulations

Together, the solar companies mentioned in the reports supply more than a third of the world’s polycrystalline silicon, which is refined from rock and ultimately transformed into photovoltaic panels installed on rooftops and energy projects worldwide, including those in the United States and Europe.

Allegations of forced labor within the supply chains of these solar companies have resulted in significant consequences. The US government has taken steps to block over 1.000 shipments of solar energy components from China’s Xinjiang region due to concerns about forced labor. Despite these concerns and efforts, the solar industry continues to expand, and the popularity of these prominent brands remains strong.

The US government has implemented measures to combat forced labor in the solar panel supply chain in Xinjiang, including prohibiting imports from silicon producers in the region. Conversely, Canada has banned imports of solar panels from specific Chinese companies due to concerns regarding human rights abuses.

Meanwhile, the Australian government, a member of the Clean Energy Council representing renewable energy firms and solar panel installers, has advocated for increased local generation and production of renewable energy. The council is also advocating for the implementation of a “certificate of origin” scheme aimed at addressing concerns surrounding forced labor.

The UK’s approach to supply chain transparency has served as a model for similar legislation in other countries, including Germany, France, and the Netherlands, all of which have enacted laws mandating due diligence in supply chains. Within the EU, Germany is actively addressing forced labor in China’s solar panel production. In response, German solar companies are urging the government to bolster the domestic solar industry and facilitate its revival.

The European Union has implemented regulations to safeguard against the use of forced labor by companies importing solar panels into the EU. These regulations mandate that companies conduct due diligence to guarantee the ethical and sustainable production of solar panels. It is essential for consumers to be mindful of the labor practices of the companies they support and to advocate for measures that prevent the use of forced labor in supply chains.

How China took over primacy from Germany

In May 2023, German Solarwatt, one of Europe’s largest producers of photovoltaic cells, announced the cessation of production.

The company, based in Dresden and established in 1993, acknowledged defeat in light of the increasingly competitive prices from Chinese products, making it unsustainable to continue operations. The closure of the plant will impact approximately 190 out of its 750 employees across Europe.

The German producer of solar panels SOLARWATT is shutting down the production. The company, which is considered one of the last major German manufacturers of solar modules, disclosed that production would cease by the end of August 2024.

The European Union’s initiative called “The Net-Zero Industry Act” couldn’t help Solarwatt. This legislation aims to accelerate the transition to climate neutrality by 2050, stipulating that 40 percent of the solar panels installed in the EU must be produced within the EU.

EU reacted, but too late for many

The act proposed in March 2024 encourages investments in clean technologies, including renewable energy sources, energy storage, hydrogen production, and carbon capture and storage. It aims to simplify and expedite the permitting process for clean technology projects and underscores the importance of developing workforce skills and training programs. Additionally, the legislation is designed to enhance the resilience of supply chains for essential raw materials and components necessary for clean technologies. According to the European Commission’s website, the law seeks to create new economic opportunities, bolster the EU’s industrial competitiveness, reduce greenhouse gas emissions, and contribute to global efforts in combating climate change.

The law comes a bit too late for Solarwatt, along with numerous European manufacturers.

Until 2012, Germany held the top position as the largest and most influential player in the solar market. At that time, the government incentivized the solar panels through feed-in tariffs, compensating solar panel owners for contributing energy to the grid. These incentives propelled Germany to become a global leader in solar energy, positioning the country at the forefront of research and development in the industry.

However, in 2013, the German government enacted changes to the law, abruptly making renewable energy more costly. This policy shift led to the collapse of the industry, resulting in the loss of seventy thousand jobs within the German solar sector. Consequently, all production shifted to China.

BiH is still a solar wild west

Solar expansion has been ongoing in BiH for several years, with investors capitalizing on the affordability of installation equipment imported from China. According to research conducted by hercegovina.info, a significant portion of the equipment used in BiH solar power plants originates from the disputed Uyghur region. However, due to the absence of comprehensive records regarding the specific regions from which Chinese products are imported, obtaining precise data on the percentage of products manufactured through forced labor is currently impossible.

Yalkun Uluyol, a professor of international relations of Uyghur descent, sought refuge in Istanbul after facing persecution by the Chinese government. He has provided multiple testimonies detailing the harrowing experiences endured by his family in the camps and the forced labor imposed on members of the Uyghur minority.

Uluyol accuses countries that import these products of complicity in the genocide against the Uyghurs.

According to Yalkun Uluyol, speaking to Taiwan Plus News, the current low prices of solar panels are artificially manipulated by the Chinese government. He alleges that behind these reduced costs lies extensive coal consumption, forced labor, substantial state subsidies, and a lack of adherence to environmental standards.

“Solar panels should inherently be more expensive due to the energy-intensive nature of their production processes. Specifically, the polysilicon production is a high energy consuming process, and this energy in China is predominantly sourced from the dirtiest coal. Consequently, if solar panels were produced without coal or in regions with higher energy prices, the final product’s costs would increase. It means that ethically produced panels has to be more expensive, but we need to remember that production of energy derived from coal doesn’t help nature, and we have to turn to the production of panels using renewable energy”.

He recommends that importing countries collaborate on a systematic solution to address the issue. “Everything should be raised to an international platform and urge the corporations to adapt and to meticulously verify the origin of the solar panels they import”.

“As consumers, importers, and buyers, we must ensure that our purchases are free from the taint of Uyghur forced labor and must seek evidence from manufacturers of a transparent supply chain that confirms the absence of components produced through forced labor,” asserts the Istanbul University professor.

Data for BiH

It is almost impossible to get concrete data for BiH.

We received data on the total import of solar panels and accompanying parts for years 2021, 2022 and 2023 from the BiH Statistics Agency.

Panels and their parts are imported according to the customs tariff under tariff numbers 8541 42 00 00 – photovoltaic cells not assembled into modules or panels, and 8541 43 00 00 – photovoltaic cells assembled into modules or panels.

In 2021, Bosnia and Herzegovina imported solar panels worth BAM 12.402.625,92 from China, with a total weight of 1.557.978,17 kg.

In 2022, there was a peak with solar panels worth BAM 45.588.795,69 imported, weighing a total of 4.384.363 kg.

However, in 2023, there was a significant drop, with only BAM 268.286 worth of panels and parts imported, weighing a total of 46.972 kg.

The origin of the significant drop in imports in 2023 is unknow, but it may be attributed to the fact that due to slow procedures in facilitating the issuance of permits to small producers, a good portion of purchased panels is being kept in warehouses until demand increases again.

In March, inquiries were sent to four importers and distributors of solar panels in Bosnia and Herzegovina, but none of them responded. Attempts to obtain information via phone were also unsuccessful, as employees were unable to provide details without consulting the directors. We couldn’t reach the directors.

We have also contracted the Foreign Trade Chamber and the Indirect Taxation Authority.

FTC BiH expressed their inability to offer significant assistance with the issue. “FTC BiH is an association of BIH businessmen whose primary task is promotion of BiH export companies. Therefore, we don’t have any knowledge regarding the matter in question”, read the Chamber’s response.

The Indirect Taxation Authority provided a similar response, explaining that their role is to implement acts originating from other levels, particularly from the Council of Ministers of BiH, specifically the Ministry of Foreign Trade and Economic Relations of BiH, which oversees the legislative aspects related to foreign trade.

We did not receive a response to our inquiry from this ministry.

Domestic production of such panels does not exist, and there was one reported case of an alleged intention to establish production in Gacko, which was reported by colleagues from the Direkt portal.

The hypocrisy of the West

Since we had no success with the institutions, we sought additional explanations from professor Damir Miljević, an economic expert with extensive experience in the areas of energy transition, energy market development, and energy economy.

Miljević stated that the institutions in BiH are not aware of anything, not even of this issue. He further commented that he has great reservations concerning this matter.

“In my humble opinion, it seems to be more about halting the Chinese, who are dominating the global market across all sectors of modern technologies with their competitive quality and pricing compared to the West, rather than being a genuine concern for people”, said Miljević.

In terms of disputed companies from China, the BiH market is primarily dominated by the Jinko group, Longi, Trina, Hanwha Q Cells, and Canadian Solar. Panels from these companies are readily available from reputable dealers in the equipment industry, typically priced between BAM 200 to 500 per panel.

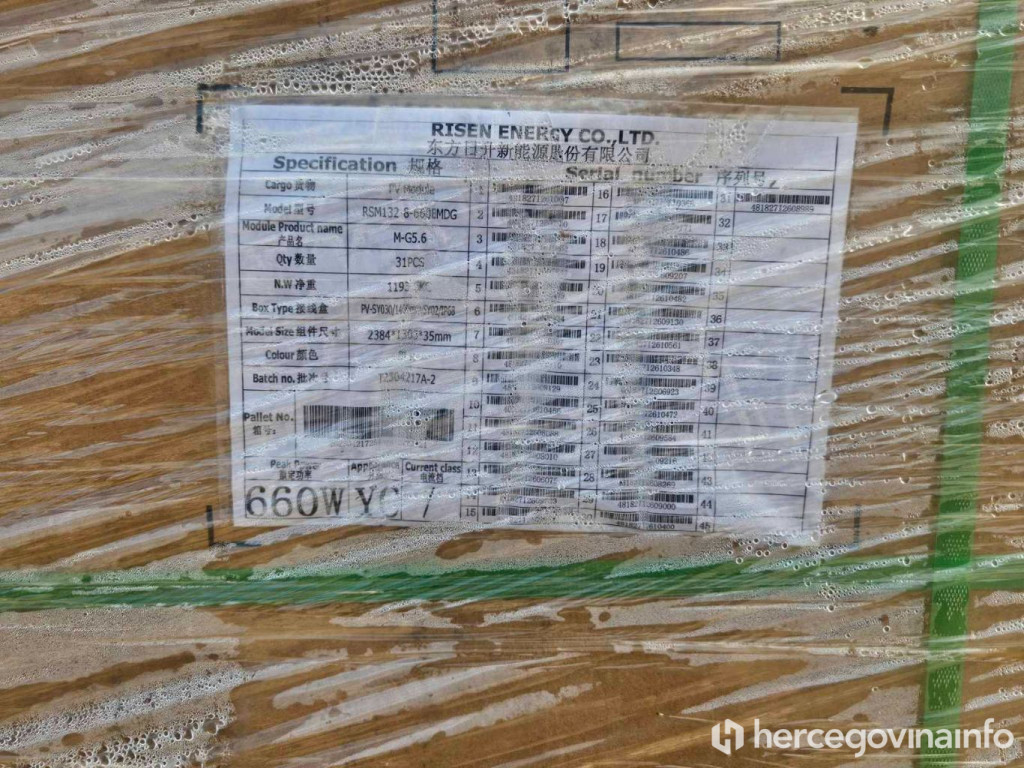

The company Risen, also of Chinese origin, was excluded from the list of companies that use forced labor. Its solar panels are being installed by numerous investors in Herzegovina, including Zdravko Mamić, i.e. his company Plavo Sunce.

The British association Business & Human Rights Resource Centre, which monitors thousands of companies to address violations of workers’ rights, sent an inquiry to Risen in 2021 regarding the use of forced labor. However, the company never responded to this inquiry.

The awareness among domestic investors, whether they are purchasing panels for their roofs or buying large quantities for installation in nature, regarding the origin of the equipment they purchase appears to be very low. Many seem to turn a blind eye as long as the prices remain low.