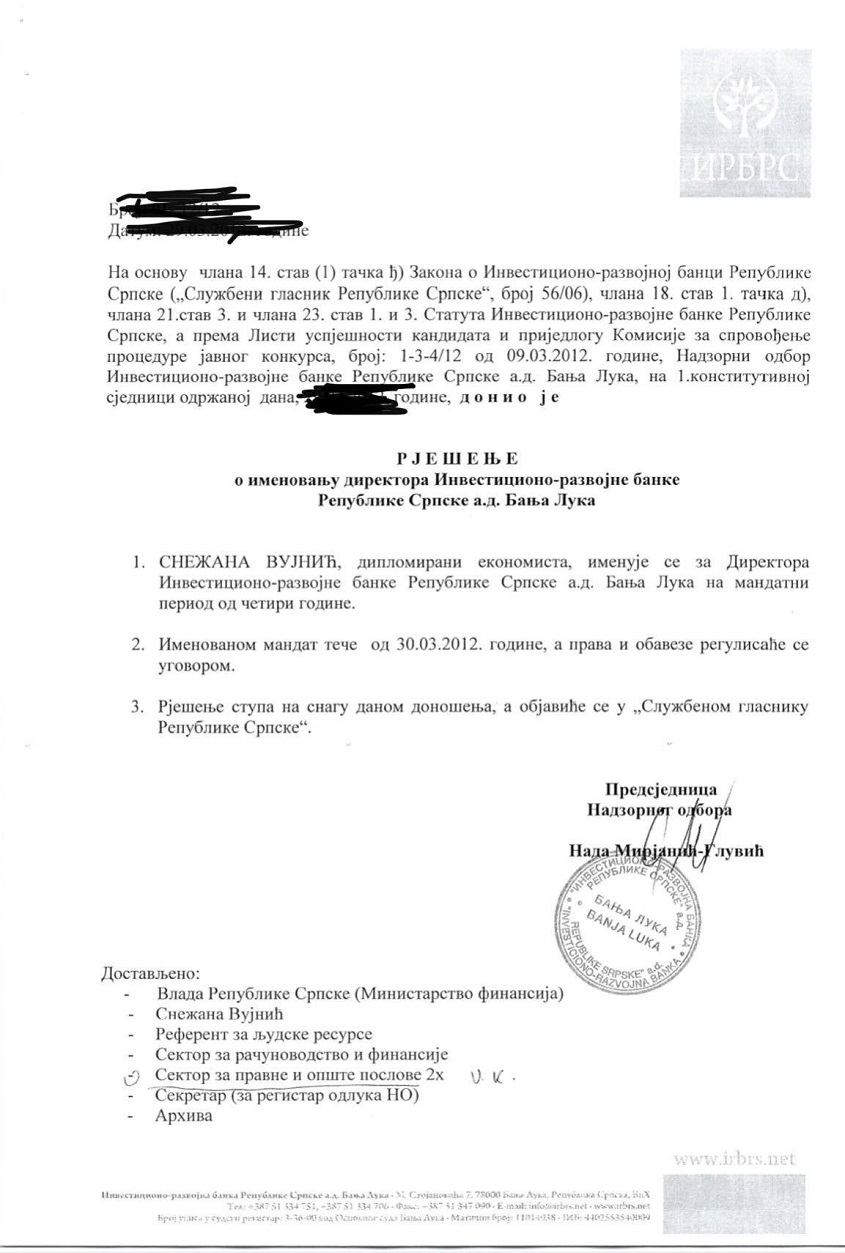

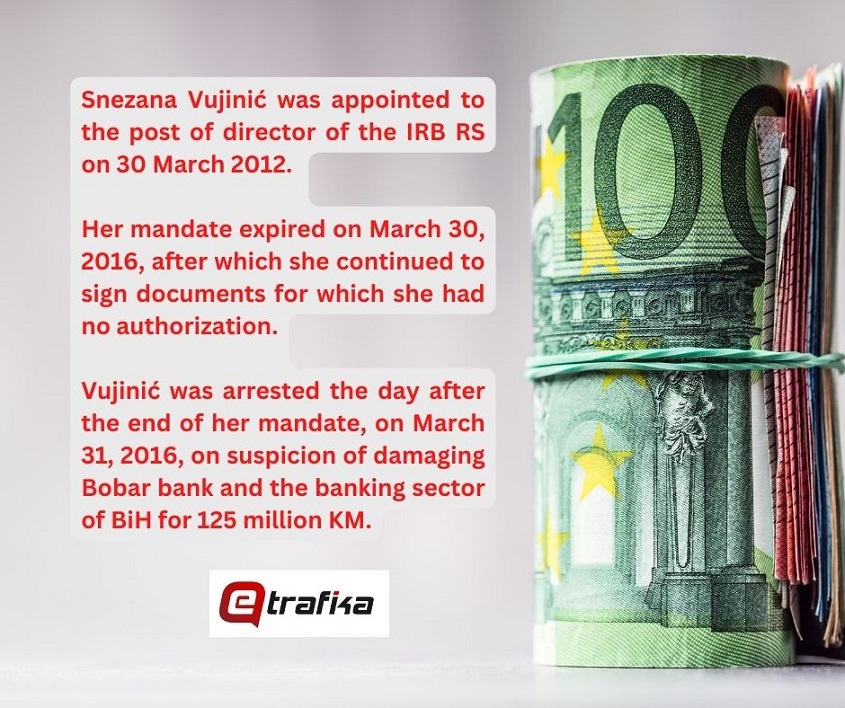

This is confirmed by a document in eTrafika’s possession, which unequivocally shows from when to when Vujnić was authorized to sign approved loans. On March 30, 2012, she was appointed to the position of director of the RBI of RS, and her mandate expired exactly four years later, after which it was not extended. Vujnić was therefore unable to sign credit obligations, although she continued to do so for four full years.

From March 30, 2016, until January 3, 2021, when the new director was appointed, all decisions of the RS IRB are illegal!

From March 30, 2016, until January 3, 2021, when the new director was appointed, all decisions of the RS IRB are illegal!

Among the illegally signed decisions, in the period when Vujinić had no authority to approve them, is the contract on establishing a lien on the real estate of the once famous “Pingvin” pastry shop in Banja Luka. Lawyer Din Tešić, who represents the owner of the aforementioned pastry shop, who sued the IRB RS, points out that the evidence obtained by our portal unequivocally confirms that all the decisions signed by Vujinić during the disputed period are illegal.

“All credit agreements and mortgage agreements are null and void, as well as all agreed bans on the sale of real estate that are the subject of securing such illegal loans. In such cases, which are clearly regulated both by the Law and by the decisions of the Supreme Court of Republika Srpska, which we will present to the court in the continuation of the procedure, the court declares the loan agreement or decision null and void, so they do not produce any consequences, that is, the IRB RS has no the right to demand the agreed interest rates, nor to have the security assets that were pledged to obtain the loan be sold through the court in the enforcement procedure”, claims Tešić.

In this case, says Tešić, the IRB RS can only claim the money that the credit user received without any interest, that is, interest, and that in a civil proceeding, not in a foreclosure sale of the debtor’s immovable property.

“This is because the mortgage was registered illegally. In the future, the question of the legality of all decisions of the IRB RS in this disputed period, as well as the funds managed by the IRB RS, especially those related to the sale of company shares and the decisions that managed the companies in which the IRB RS, that is, Action fund of Republika Srpska owns the shares,” says Tešić.

This means that everything that Vujnić signed during that period should be declared illegal and returned to its original state, that the registered mortgages are invalid and that the IRB RS can now demand only principal from the debtor, but not interest.

After her mandate and powers expired, Vujnić continued to sign credit obligations until she left the director’s chair, regardless of the fact that she could not sign a single paper. This is now being used by numerous clients who have filed lawsuits and are demanding that their debts be cancelled and their loans written off, which will cost the Republika Srpska budget millions of KM.

It is interesting that during the four-year period Vujnić was not re-appointed to the position of director, nor was she granted the status of acting officer, so she performed all tasks in this bank without authorization.

It is interesting that during the four-year period Vujnić was not re-appointed to the position of director, nor was she granted the status of acting officer, so she performed all tasks in this bank without authorization.

She was appointed to this position in 2012, and a few days before the end of her four-year mandate, in 2016, she was arrested on suspicion of having participated in multimillion-dollar bank embezzlement. It is about Bobar bank, and a group of authorized persons who are still on trial, including the former director of the RBI, who are accused of withdrawing over 125 million KM from the bank.

After her release from custody, despite the accusations against her, the authorities of Republika Srpska, led by the then president Milorad Dodik, returned her to her old position. She is returning to work, although her mandate has since expired and she has not received a new appointment or acting status. Without a new appointment decision, she worked as a director of the largest bank in the RS until 2020.

It remained unclear how Vujinić could work for a full four years after the end of her mandate and sign approvals for loans without the authorization of the Supervisory Board for the tasks she performs. In fact, it is not clear on what basis she received her salary and if she worked for a salary at all.

This affair could cost the entity’s budget several tens of millions of KM because the above became the basis for a lawsuit against those who took out loans through the IRB during the period in which Vujinić could not sign such decisions, and will processes that are being prepared to ask for the annulment of the decisions.

Furthermore, this will not mean the return of money to the RBI budget, because it has been spent a long time ago, and among the loaned companies there are also a number of those close to the authorities that received money even though they were about to be shut down. One of them is the mentioned pastry shop “Pingvin”, at that time close to the top of the ruling SNSD, which received the money even though the media had written for months that it was about to collapse, which later happened. The loan has not been returned and there is no longer any hope that such a thing will happen, and the key defence of the former managers of this company is precisely that the decision on the loan is null and void.

Owner of “Pingvin” Slavica Grebenar, one of her loans were approved in a period when Vujinić did not have the authority to sign it, and now it is clear that it will be null and void due to illegalities related to improperly calculated variable interest rates.

A similar thing happened when the mandate of the members of Republika Srpska Securities Commission expired, so the Supreme Court of Republika Srpska confirmed the position of the lower court that the authorizations after the expiration of the mandate are of a technical nature and that the activity is limited to the tasks within the so-called technical mandate, which means that no acts can be passed that impose rights and obligations on other subjects.

According to the current laws, claims lawyer Bojana Vranješ Ćoćkalo, when the term of office of a board member (director) is determined by a number of years, months or days, then at the end of the last day of the mandate period, the named person is no longer a member of the board.

“Actions taken by a person whose mandate has expired cannot be considered as actions of a member of the board, because that person is no longer authorized to make them,” she explained.

We also requested a statement on this issue from the Investment Development Bank of RS, but they did not answer our questions until the end of this text. We asked them in which period Snežana Vujnić was the secretary of the IRB RS and requested the exact date, as well as whether a decision was made to appoint her for a second term after March 30, 2016, with a request that this decision be delivered to us. We also asked them to comment on the claims that the clients will demand the annulment of the loan agreement and the establishment of a lien on movable and immovable property due to the illegal signing of loan applications, because Vujinić was not authorized to sign.

(eTrafika)